GRC failures: how the lack of control brought down Will Bank

When growth masks fragility

In the early years, Will Bank seemed to have found the ideal formula: financial inclusion with digital scale. The brand grew among the least banked classes, attracting robust investments and reaching millions of customers. However, behind the expressive results, critical governance, risk and compliance structures (GRC) remained fragile, outdated and disconnected from growth.

In regulated businesses, such as the financial sector, expanding without maturity in GRC is walking on a thin line, where the slightest deviation can escalate to a systemic collapse. And that's exactly what happened. The absence of a control framework commensurate with operational complexity meant that ignored risks turned into real damage.

The risk turn: the acquisition by Banco Master

When Banco Master assumed control of Will Bank, in 2024, the market interpreted the move as a strategic consolidation. In practice, what happened was the transfer of frailties. Dependence on a financially unstable controller has become the weakest link in an already strained current.

Without efficient risk management mechanisms and response to critical events, Will Bank did not resist the deterioration of the controlling group. In November 2025, with the extrajudicial liquidation of Banco Master, Will entered into operational collapse: blockage in the payment system, breach of contracts and direct impact on more than R$ 7 billion in liabilities. A shock that extrapolated the walls of the company and reached the integrity of the financial ecosystem itself.

GRC failures generate risks that spread

CRM failures are not limited to internal controls. They generate distrust, overload guarantors and put pressure on the entire regulated sector. When a company fails to guarantee its continuity in the face of a crisis, it is not just a question of compliance, it is a question of systemic sustainability.

The Will Bank case serves as an alert for companies that treat GRC as a documentary obligation or as a regulatory checklist item. Real governance requires integration between areas, data, decisions and controls. It requires predictive vision and automation. It requires a new level of operational intelligence.

Technology is not support, it is lever

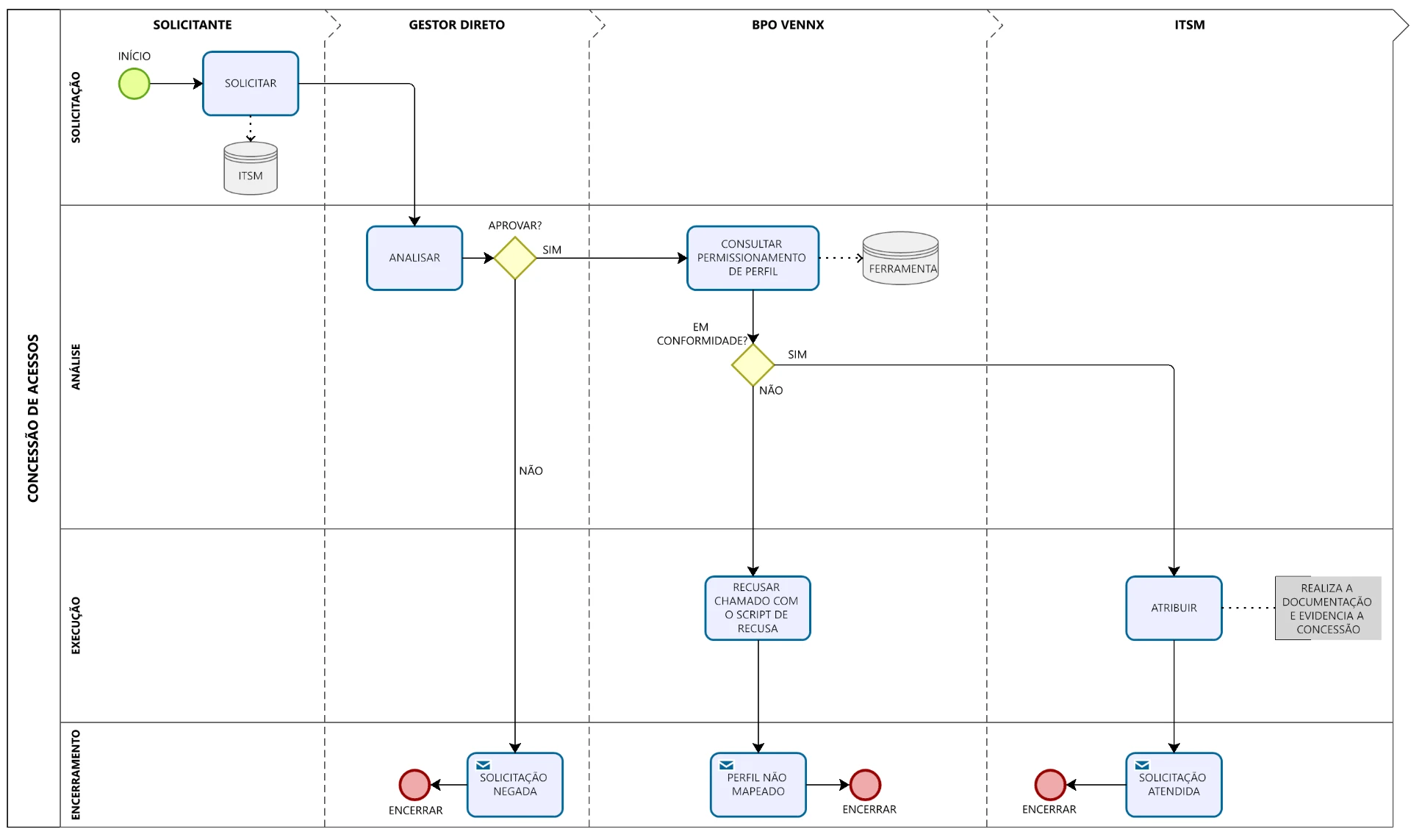

Technology, in this context, needs to be more than an administrative support. Tools like Vennx's Oracle eliminate undue permissions, fix bugs automatically, and ensure full visibility into risks in real time. With this, GRC ceases to be a bureaucratic liability and becomes a strategic asset.

Resilient organizations are those that continuously monitor, adjust and learn. They are those who treat the data as a source of decision, and not as a historical record. And that they build their scalability based on control, predictability and governance applied from day zero.

Conclusion: without GRC, growth is unsustainable

The collapse of Will Bank was not an accident. It was the natural consequence of a structure that grew faster than its ability to protect itself. Governance cannot be built when the crisis has already begun. She needs to be at the foundation of the business.

Is your company ready to withstand an adverse scenario? Or does it still depend on manual flows, fragmented processes and data that do not converse with each other?

Vennx delivers real solutions, with applied intelligence, automation and strategic vision to make GRC the engine of your scalability, not the throttle.

Posts Relacionados

Informação de valor para construir o seu negócio.

Leia as últimas notícias em nosso blog.

Real Case: How We Use AI to Create 20 SoD Arrays in 7 Days

How we use AI to create 20 SoD arrays in 7 days and structure access governance before SAP.